The Chicago firefighters pension fund has filed claims with the Illinois comptroller for $3.3 million in shorted pension contributions, an action that could worsen city finances and service delivery.

Chicago could be the latest municipality to face diversion of state money as a result of a pension intercept law that took full effect in 2018. Under that law, municipalities that fail to make full contributions to their police or fire pension funds can see state money meant for the local government diverted directly to the pension funds instead.

According to The Bond Buyer, the Firemen’s Annuity and Benefit Fund of Chicago filed two claims with the Illinois comptroller for a combined $3.3 million shortage, alleging the city shorted it by $1.8 million in 2016 and by $1.5 million in 2017. While these are relatively small amounts for such large pension funds, there is no ignoring the city’s enormous pension problem and its crowding-out effects on core services for residents.

Bond Buyer reported that the city will likely contest the fund’s claims. The amount of the full, or “actuarially required,” contributions to municipal pension funds each year is determined by either the Illinois Department of Insurance or an independent actuary employed by the pension fund or municipality.

Under the pension intercept law, the Illinois comptroller must withhold state funds owed to a local government once a pension fund makes a claim for pension payments owed. For most municipalities, the comptroller can intercept all money owed to local entities from the state – including sales and income tax collections on behalf of municipalities – but for the city of Chicago, the comptroller can only withhold grant money from the state.

Hearken back to Harvey

As a result of the more limited pool of money that is subject to withholding, and the fact that Chicago shorted a smaller portion of its total pension contribution, the Windy City is unlikely to face immediate consequences as severe as those in Harvey, Illinois. In spring 2018, Harvey became the first municipality to have state funds withheld under the pension intercept law. The city laid off nearly half of its police and fire forces as a result.

That said, Chicago cannot avoid the consequences of pension crowd-out for long. Chicago- related pension systems are nearly $42 billion in debt.

Led by outgoing Mayor Rahm Emanuel, the city has already pursued near-sighted solutions to its pension crisis. Emanuel pushed through massive multiyear tax hikes, including a property tax increase of $543 million, new taxes on ridesharing and e-cigarettes, tax increases on water and sewer services and 911 calls, and hikes in fees ranging from garbage collection to building permits.

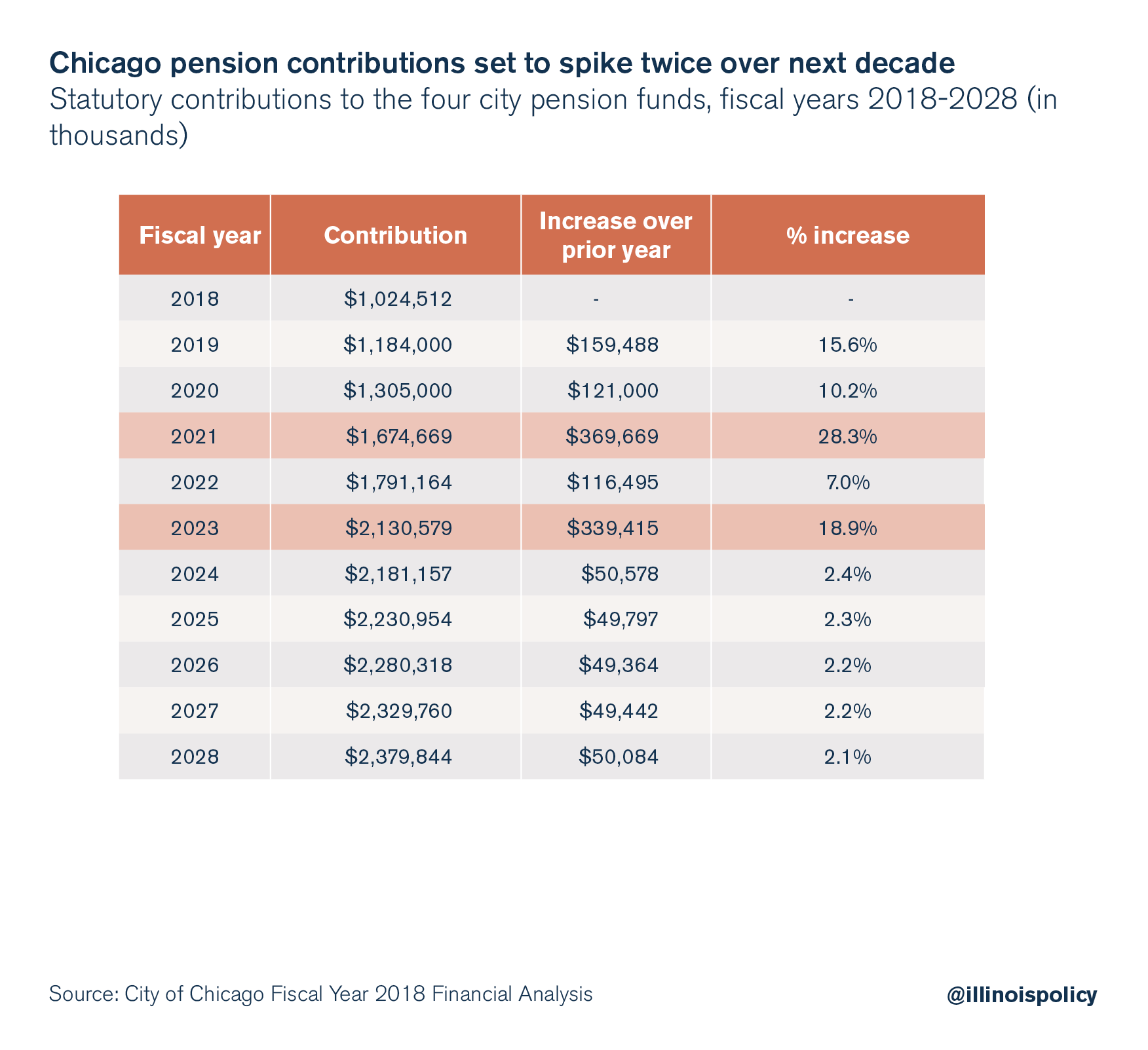

The mayor also lobbied for the Illinois General Assembly to allow Chicago to make reduced pension contributions over the course of five years – set forth in public acts 99-0506 and 100-0023. Contributions are set to spike by hundreds of millions of dollars over the next five years, ending in an annual contribution that is $1 billion higher than this year.

Unfortunately, Chicago and Harvey are not alone in facing pension-induced financial crises that threaten to crowd out core government services. Peoria, Illinois, recently issued layoff notices to more than two dozen employees as a result of ballooning pension costs, even without having faced an intercept claim by one of its pension funds. Nearly 60 percent of Illinois’ downstate police and fire pension funds did not receive full payments in 2016, according to research by Wirepoints, meaning hundreds of municipalities are vulnerable to the state’s intercept law.

Addressing pension pain points

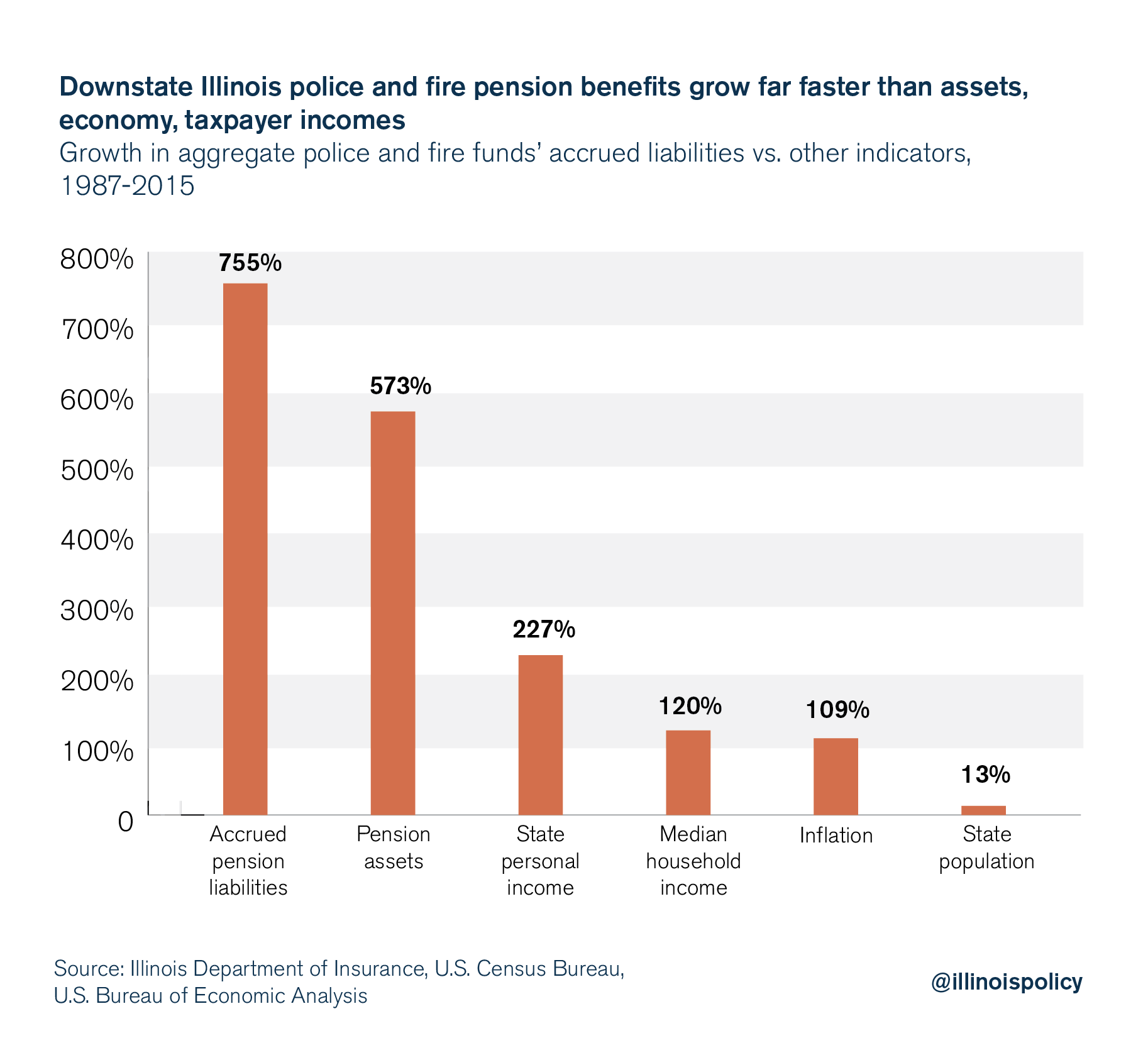

The cause of the local pension crisis in Illinois is that promised benefits – or accrued pension liabilities – are growing far faster than taxpayers’ ability to pay for them.

The only way out for Chicago and other struggling municipalities is meaningful pension reform that starts with a constitutional amendment to allow changes in future, not-yet-earned benefit accruals for current workers and ends with moving all new hires into 401(k)-style personal retirement accounts.

Real, lasting pension reform is the only way to protect taxpayers from further tax hikes, protect government worker retirement security from fund insolvency, and ensure state and local governments can continue to provide core services such as education and public safety.