HEALTH CARE COSTS CONSUME 25 PERCENT OF ILLINOIS’ BUDGET

Illinois state-worker pension costs get well-deserved attention for crowding out spending for much of the state’s other services. With pension costs now consuming more than 25 percent of the budget, they compromise spending on everything from social service providers to in-state college scholarships for low-income students.

But there’s another budget item that deserves similar attention for the squeeze it’s putting on other government services: Medicaid. Health care costs largely made up of Medicaid expenses consume 25 percent of Illinois’ general fund budget. The governor’s recommended 2017 budget appropriated $8.2 billion to health care out of an expected $32.1 billion in general fund revenues. Without serious Medicaid reforms, spending will continue to compromise other programs that help the needy.

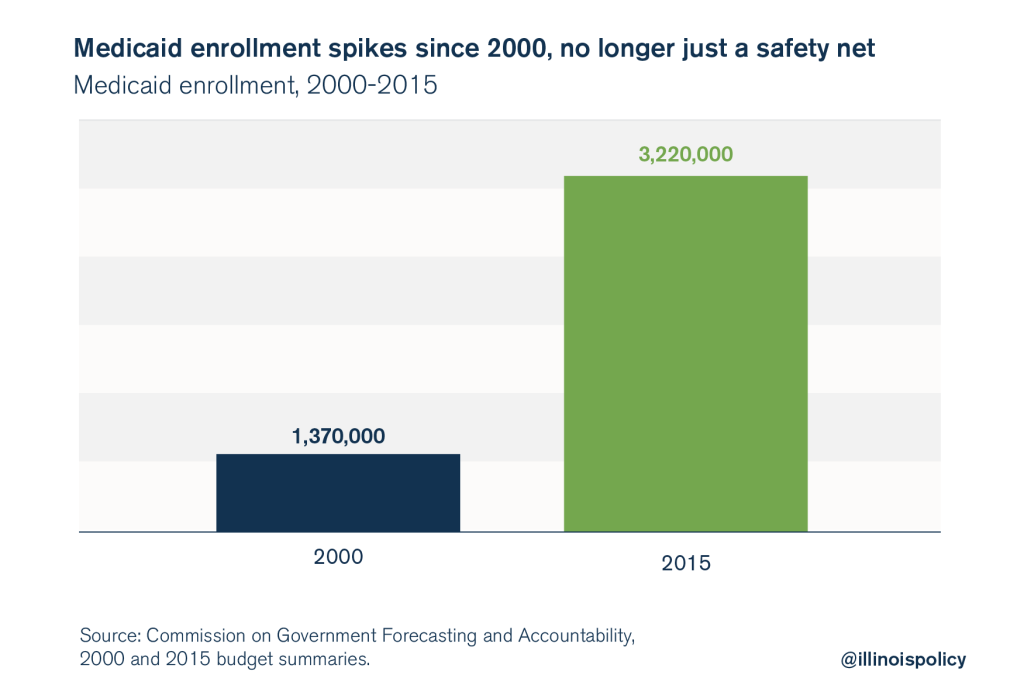

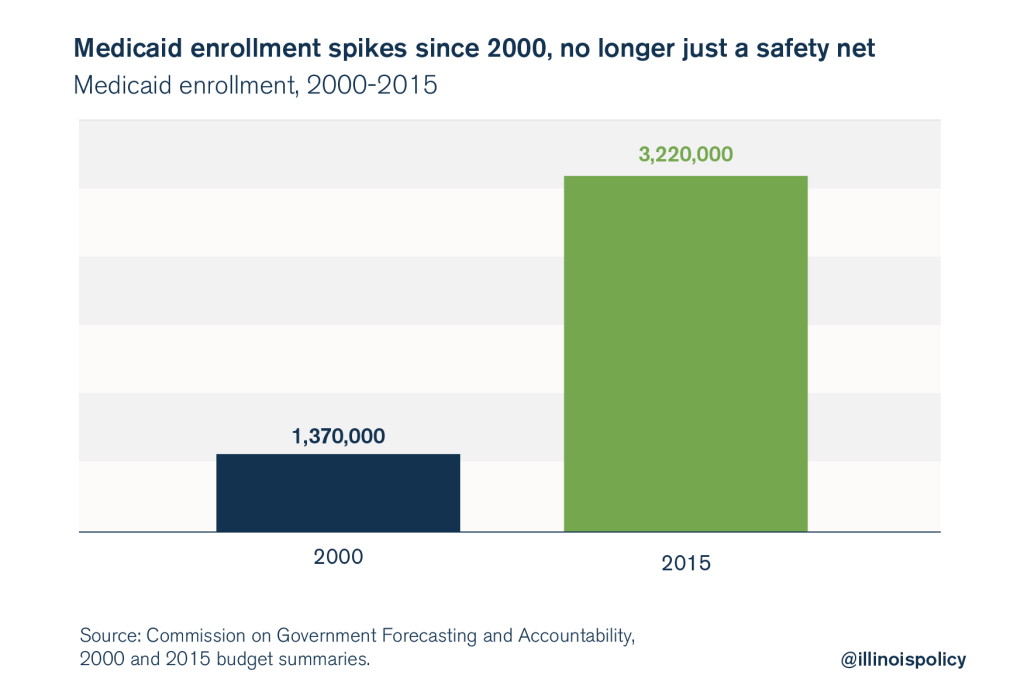

Medicaid, a state-federal partnership originally meant to be the health care safety net for the poor and disadvantaged, has ballooned to cover more than a quarter of Illinois’ population. It’s no longer just a safety net.

In 2000, just 1.37 million, or 11 percent, of all Illinoisans were enrolled in Medicaid. Today, enrollment has swelled to 3.22 million – a 135 percent increase.

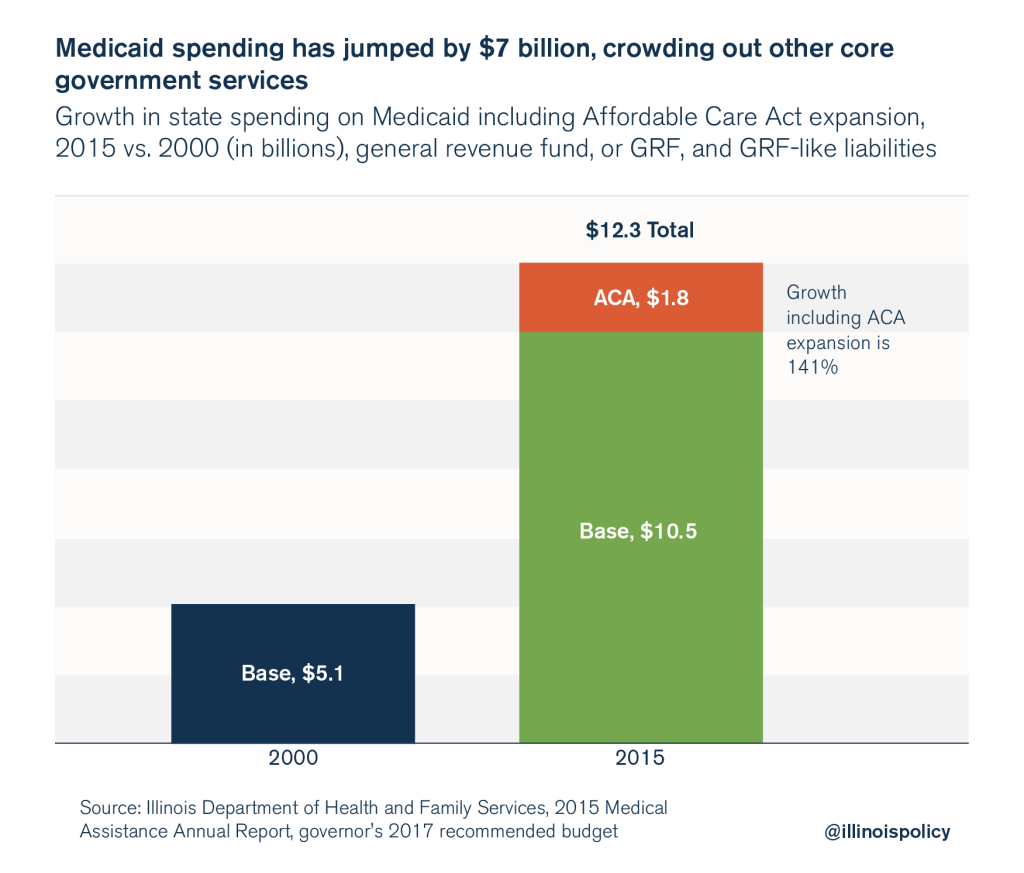

As the number of Medicaid enrollees has increased, costs have increased as well. Since 2000, total general revenue fund, or GRF, and GRF-like Medicaid costs have increased by $7 billion. That increase alone is nearly what Illinois state government appropriates for K-12 education each year.

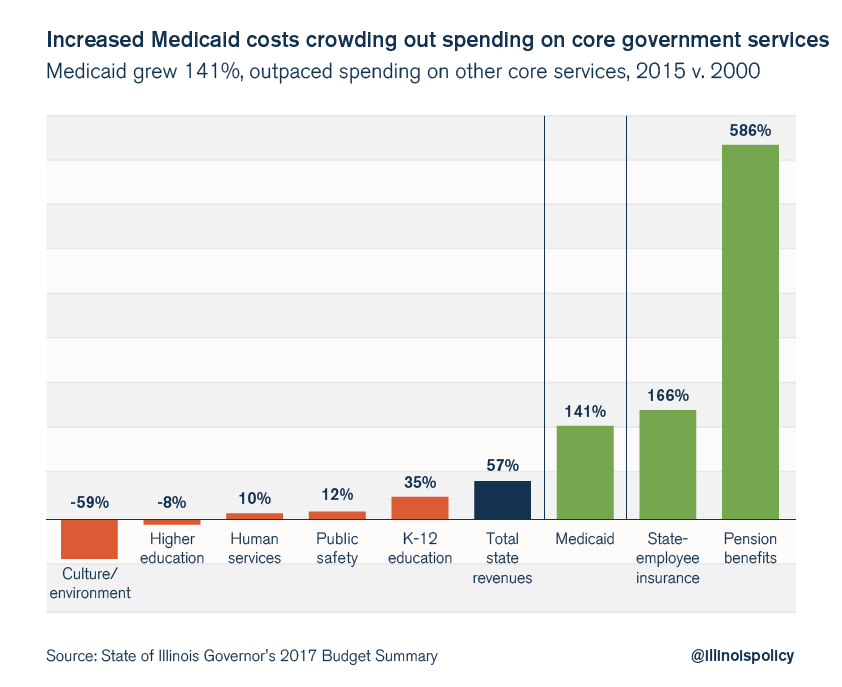

When compared with spending in 2000, those GRF and GRF-like Medicaid expenditures have grown by 141 percent – far more than the growth in tax revenues and spending on other core services.

By contrast, general fund state spending on human services is up just 10 percent over the same period. Spending on K-12 education is up just 35 percent. Higher education spending is down by 8 percent.

The bottom line is, unless Springfield reforms its core spending drivers, the costs will swallow up more and more of Illinois’ general budget.

And contrary to many politicians’ assertions, tax hikes are not the solution. Revenues have never been a problem in Illinois: It is costs that are growing too fast. State per capita tax revenues have grown 70 percent more than inflation over the last 33 years. Any tax increases will put additional pressure on overburdened taxpayers – encouraging them to seek opportunities in other states.

The state’s financial crisis will cease only when politicians are brave enough to say no to the status quo – and that means structurally overhauling Illinois’ budget by passing comprehensive spending and economic reforms.