Pritzker has been pushing hard for a progressive income tax amendment as a way to generate $3.7 billion for state spending.

Illinois Gov. J.B. Pritzker just contributed $51.5 million to a committee working to convince voters Nov. 3 to back a progressive income tax structure in Illinois, which could result in tax hikes of up to 47%

on 100,000 small businesses.

The tax change also opens the door to taxing retirees.

Pritzker almost single-handedly has been funding the Vote Yes for Fairness committee being run by his former deputy campaign manager. Besides the $51.5 million donated June 26, he gave $5 million in December.

One other individual donated $250, according to the Chicago Tribune.

A progressive tax was one of Pritzker’s signature campaign promises, but despite his Robin Hood rhetoric about taxing the rich, the tax can significantly hurt lower-income workers.

Pritzker promises tax relief, yet his tax rates would save $6 for someone already paying $1,800 in state and local taxes on a salary of $12,400. That $6 saving was more than outstripped by Pritzker in 2019 when he signed the $100 gas tax hike and $50 vehicle sticker hike, which fell disproportionately on the poor.

Progressive taxes also would impact Illinois’ most fertile source of jobs, with tax hikes of up to 47% on more than 100,000 small businesses. The tax would make it harder to recover from COVID-19 and make it harder to return to work for 1.38 million Illinoisans idled by the pandemic.

“I believe that if they impose the progressive tax you will see even more people leave the state,” said Michael Patricoski, a dentist from Palos Heights. “You could never run a business as the state runs using our money. They think it is an unending wallet upon which they can draw money from. You cannot continue to outspend your revenue.”

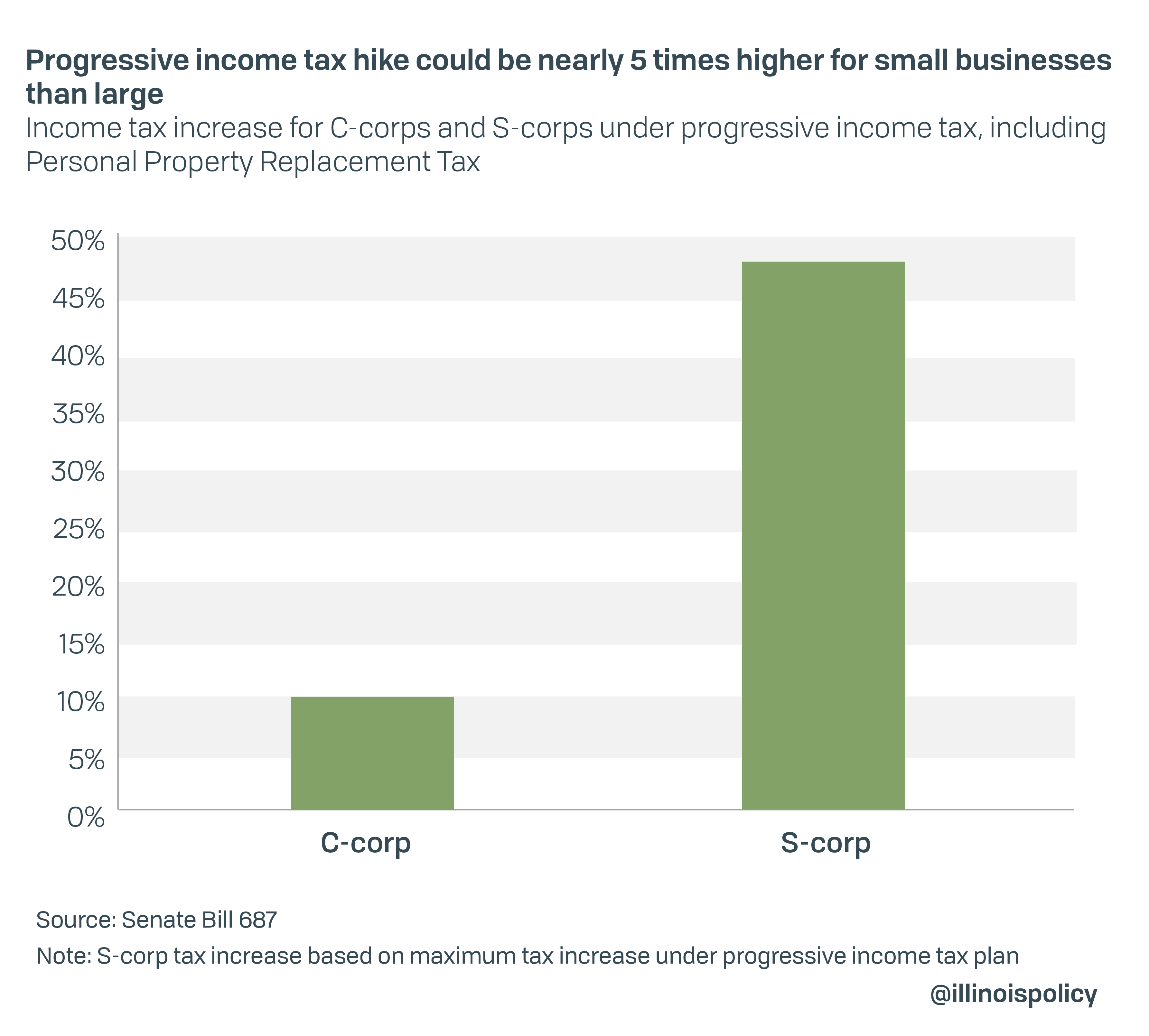

Compared to large corporations, small businesses may see their taxes increased five times higher.

Corporations are facing a 10% tax increase from 9.5% to 10.49%, but small businesses will see their tax rates jump from 6.45% to 9.49%. Illinois would then have the third-highest tax rate on businesses in the country.

Research shows more than half of all U.S. small businesses might have to close their doors from ongoing COVID-19 restrictions. As many as 21,700 restaurants could be gone in Illinois, but the impacts are across business sectors.

“If it continues the way it is right now, I can’t see myself surviving the next three months,” said Corrine Campbell, the owner of a small boutique in Springfield.

In addition to raising taxes on job creators, the progressive income tax is shaping up to be a way for state lawmakers to institute a retirement tax: Every state with a progressive income tax also taxes retirement income. Even state Treasurer Michael Frerichs said approving a progressive income tax is the first step toward taxing retirement income.

The economic hardships created by Pritzker’s COVID-19 mandates would be amplified by imposing a tax that would draw $3.7 billion out of the state economy during a recession, a move economists roundly reject as a bad idea. Yet when pressed at an April news conference about reconsidering the progressive income tax amendment to reassure business owners, Pritzker said Illinois “needs it now more than ever.”

What Illinois needs now more than ever are not Pritzker’s tax reforms, but rather spending reforms.